florida estate tax exemption 2020

You must make the property your permanent residence by January 1 2020 in order qualify. Below is a summary of the 2020 figures.

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

However you have until March 2 to file your application with the property appraiser s office.

. Federal Estate Tax. Portability continues to greatly increase the power of this exemption for married couples who can now leave up to 2316 million without paying estate tax. The state abolished its estate tax in 2004.

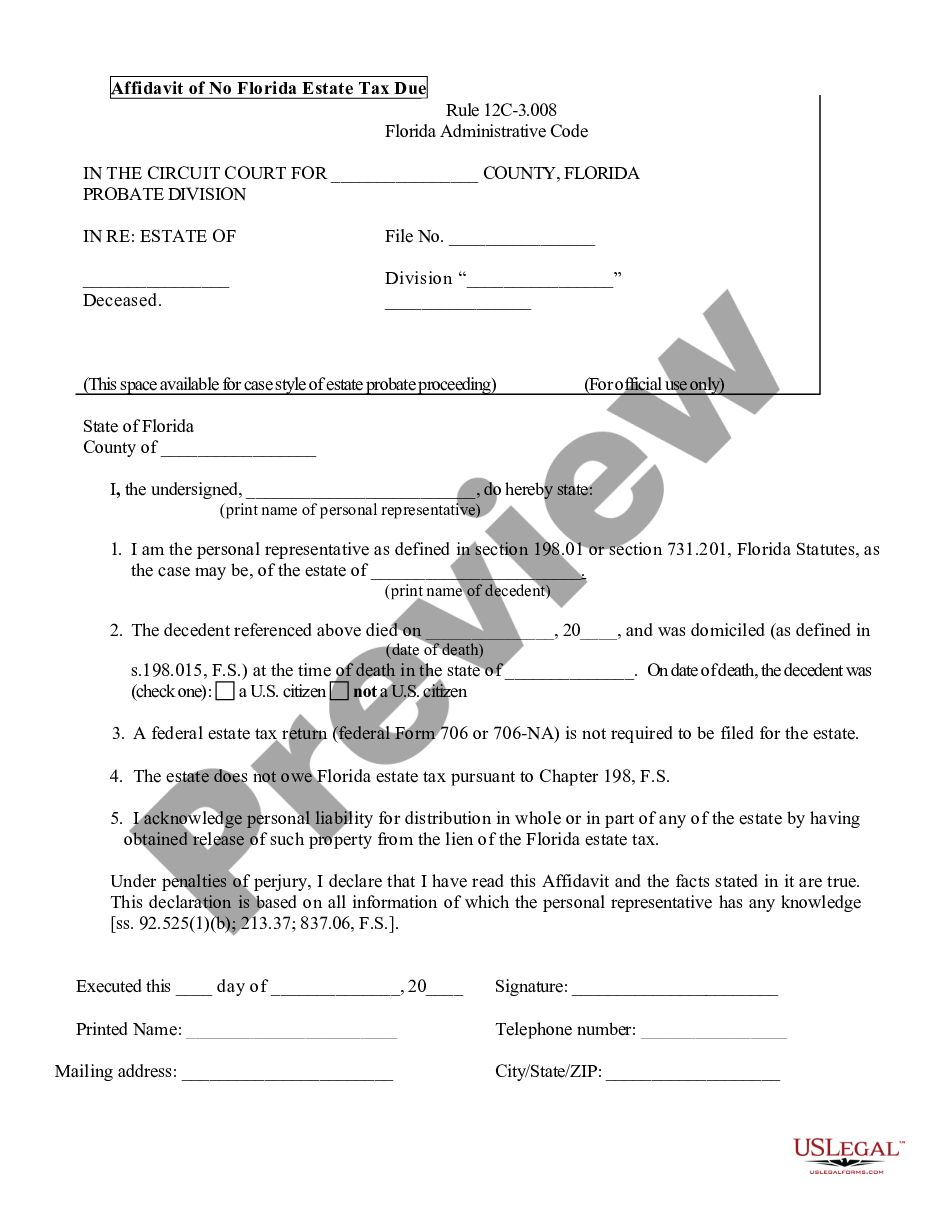

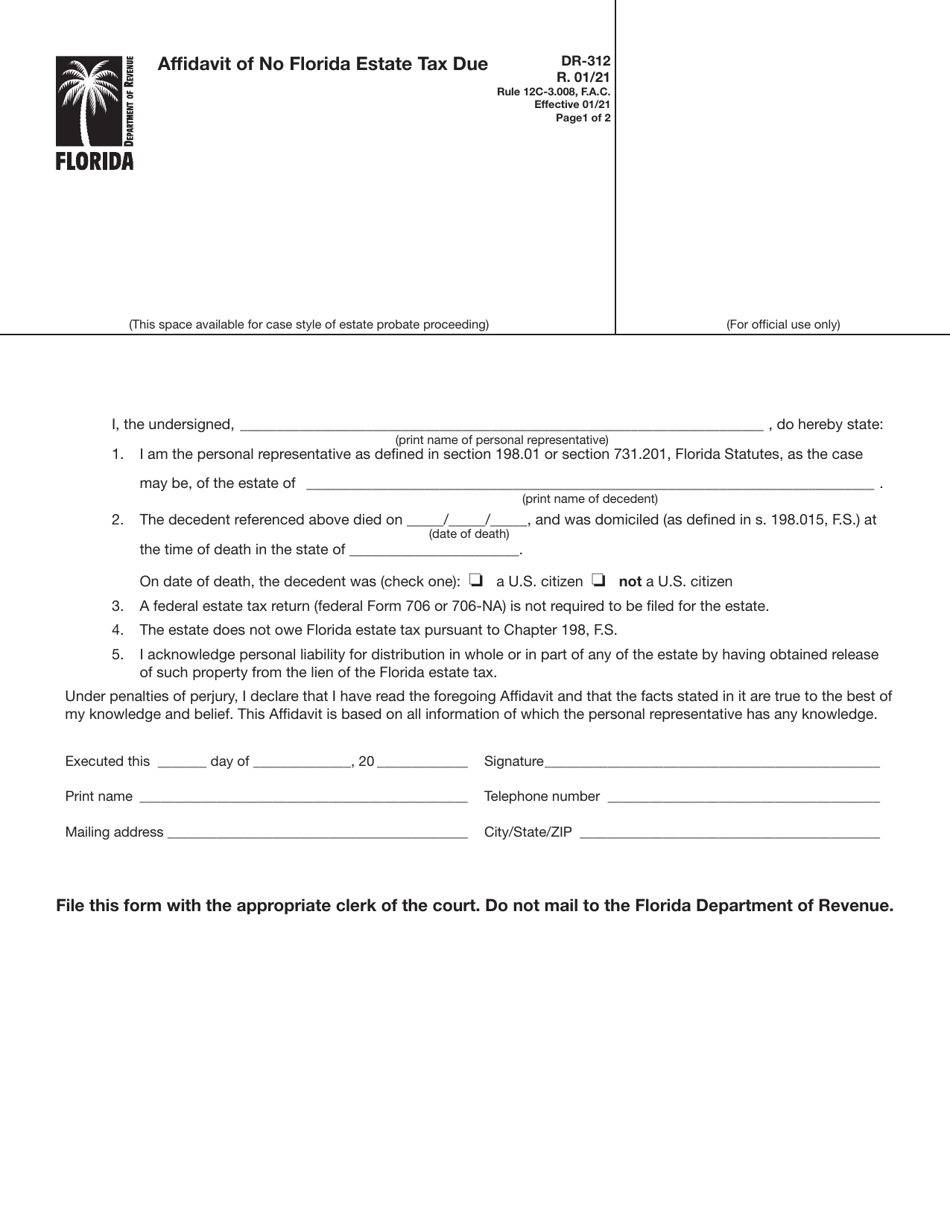

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706PDF PDF. Any assets left to your heirs will be taxed at a 0 rate up to 1158 million and at a 40 rate beyond that amount. You ought to fill out the Affidavit of No Florida Estate Tax Due form and check out it.

Estate tax exemption which may also be expressed in the form of a unified credit. New Estate Tax Exemption Limits for 2020. These figures are adjusted annually for cost-of-living increases.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent the property owner may be eligible to receive a homestead exemption that would decrease the propertys taxable value by as much as 50000. The federal estate tax exemption for 2022 is 1206 million. Estates of decedents survived by a spouse may.

This may sound complicated but the end result is actually quite simple. The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts for estate gift and generation-skipping transfer GST taxes. Florida used to have a gift tax but it was repealed in 2004.

What is the federal estate tax exemption for 2020. Property taxes in Florida are right in the middle of the pack nationwide with an average effective rate of 102. Citizens and Residents Annual Gift Tax Exemption - 15000 US.

The late filing deadline for all 2020 exemptions is September 18 2020. This may sound complicated but the end result is actually quite simple. Florida estate tax exemption 2020 Sunday March 6 2022 Edit.

Citizens only Nonresident Alien Estate Tax Exemption - 60000 may be subject to foreign treaty Gifts to Non-Citizen. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40. The estate tax exemption in 2021 is 11700000.

Ad From Fisher Investments 40 years managing money and helping thousands of families. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Technically this is structured as a tax credit.

Estate Tax Exemption for 2021. The agreement must be at a single hotel apartment house roominghouse touristtrailer camps or condominium. Citizens and Residents Gifts Between Spouses - Unlimited US.

So if a married couple plans properly they can have an exemption of up to 234 million after both spouses have died. It seems like every year the amount of an estate that is exempt from taxes increases. When a bona fide written agreement for continuous residence of longer than six months is entered into the rental or lease of living or sleeping quarters is exempt from sales and use tax.

The size of the estate tax exemption meant that a mere 01 of. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. If an estate exceeds that amount.

The timely deadline to file for all 2020 exemptions is March 2 2020. While the largest increase in recent history occurred between 2017 and 2018 this is the second year in a row with a more moderate increase. To ensure that all things are exact contact your local legal counsel for assist.

History of the Florida Estate Tax. Homestead Exemption Save Our Homes Assessment Limitation and Portability Transfer. You also pay 34 on the remaining 70000 which comes to 23800.

Get Access to the Largest Online Library of Legal Forms for Any State. The 2020 limit after adjusting for inflation is 1158 million. This is an incremental increase from 114 million in 2019.

The Gift Tax Exemption is the threshold for the sum of assets that an individual can distribute to another without having such transfer count against their life time gifting. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. SmartAsset has a In estate planning it is key to know how much your assets total including your savings.

11400000 in 2019 11580000 in 2020 11700000 in 2021 and 12060000 in 2022. The historically high lifetime exemption amount for gift estate and generation-skipping transfer taxes increased from 114 million to 1158 million on January 1 2020. Any assets left to your heirs will be.

Florida also has no gift tax. The estate tax exemption is adjusted for inflation every year. Up to 25 cash back Unless your taxable estate is worth more than 1158 million your estate will not owe federal estate tax if you die in 2020.

In the year 2020 the Estate Tax Exemption has increased to 1158 million which is an increase of about two-hundred thousand 20000000 dollars 114 million for the. Is a federal exemption that was eliminated for tax year 2018 but is available once again in 2019 and will be in 2020 as well. November 19 2019 Posted by RLA Estate Planning Law News and Press Probate Real Estate Law Tips Trust Administration The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019.

As of 2016 the following Estate and Gift tax exemptions are in effect. Estate tax is calculated on all of your assets when you die and theres a nonrefundable credit equal to the tax that would be charged on the lifetime exemption 4577800 in 2020. Florida estate tax exemption 2020.

Register and easily find around 85000 useful samples. Currently there is no estate tax in Florida. There is no gift tax in Florida.

Sticky Post By On 24. Still individuals living in Florida are subject to the Federal gift tax rules. Citizen may exempt this amount from estate taxation on assets in their taxable.

Estate Tax Exemption - 11580000 US. The Department of Revenue Department. The federal estate tax exemption is portable for married couples.

The Estate Tax is a tax on your right to transfer property at your death. The exemption amount will rise to 51 million in 2020 71 million in 2021.

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Does Florida Have An Inheritance Tax Alper Law

Does Florida Have An Inheritance Tax Alper Law

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Inheritance Tax In Florida The Finity Law Firm

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Florida Attorney For Federal Estate Taxes Karp Law Firm

Pga Village Verano Move In Ready Homes Https Boldrealestategroup Com Pga Village Verano Move In Ready Homes Florida Real Estate Village Real Estate

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

Affidavit Of No Florida Estate Tax Due Florida Estate Us Legal Forms

Does Florida Have An Inheritance Tax Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Strategies For Gifting Money And Assets In An Estate Plan Deloach Hofstra Cavonis P A

Florida Property Tax H R Block

U S Estate Tax For Canadians Manulife Investment Management

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate Tax Rules On Estate Inheritance Taxes

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller